Is College Tuition Tax Deductible 2020 . when the tuition and fees deduction was still in effect, those who attended an accredited college, university,. education, especially college tuition, can be a big financial burden for students and their parents. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction.

from www.formsbank.com

when the tuition and fees deduction was still in effect, those who attended an accredited college, university,. in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. education, especially college tuition, can be a big financial burden for students and their parents. learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction.

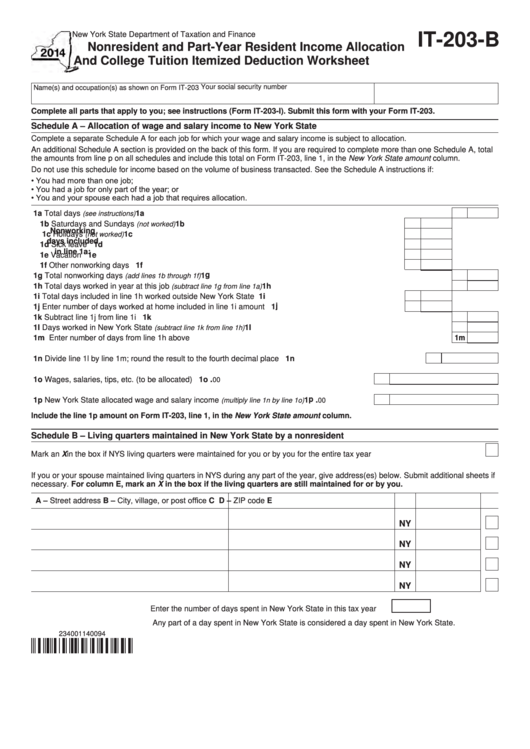

Fillable Form It203B Nonresident And PartYear Resident

Is College Tuition Tax Deductible 2020 in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. education, especially college tuition, can be a big financial burden for students and their parents. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction. learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. when the tuition and fees deduction was still in effect, those who attended an accredited college, university,.

From lorrainewlexie.pages.dev

Is College Tuition Tax Deductible 2024 Magdaia Is College Tuition Tax Deductible 2020 in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. learn how to deduct up to $4,000 for qualifying tuition expenses. Is College Tuition Tax Deductible 2020.

From dxokymive.blob.core.windows.net

Is College Tuition Tax Deductible For Parents 2019 at Donna Gutierrez blog Is College Tuition Tax Deductible 2020 education, especially college tuition, can be a big financial burden for students and their parents. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. when the tuition and fees deduction was still in effect, those who attended an accredited. Is College Tuition Tax Deductible 2020.

From ronnyqcourtenay.pages.dev

Is Tuition Tax Deductible 2024 Cami Marnie Is College Tuition Tax Deductible 2020 learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. when the tuition and fees deduction was still in effect, those who attended an accredited college, university,. use this form to deduct qualified tuition and fees paid in 2018, 2019,. Is College Tuition Tax Deductible 2020.

From www.youtube.com

Personal Financial Planning Tips How to Use College Tuition as a Tax Is College Tuition Tax Deductible 2020 in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later. Is College Tuition Tax Deductible 2020.

From dxokymive.blob.core.windows.net

Is College Tuition Tax Deductible For Parents 2019 at Donna Gutierrez blog Is College Tuition Tax Deductible 2020 use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. in general, qualified tuition and related expenses. Is College Tuition Tax Deductible 2020.

From standard-deduction.com

2020 Tax Deductions Standard Deduction 2021 Is College Tuition Tax Deductible 2020 learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. use this form to deduct qualified tuition and fees paid in. Is College Tuition Tax Deductible 2020.

From taxfoundation.org

How is Tax Liability Calculated? Common Tax Questions, Answered Is College Tuition Tax Deductible 2020 learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction. learn about the tax credits and deductions you can use to offset the. Is College Tuition Tax Deductible 2020.

From www.forbes.com

Here’s Your Guide To 2020 Rates For 401k’s, Student Loans & More Is College Tuition Tax Deductible 2020 use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction. learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. in general, qualified tuition and related expenses for the education tax credits include. Is College Tuition Tax Deductible 2020.

From bold.org

2024 College Tuition Tax Deduction Questions & Answers Is College Tuition Tax Deductible 2020 learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. when the tuition and fees deduction was still in effect, those who attended an accredited college, university,.. Is College Tuition Tax Deductible 2020.

From www.rochester.edu

University announces tuition rates, financial aid for 201920 Is College Tuition Tax Deductible 2020 when the tuition and fees deduction was still in effect, those who attended an accredited college, university,. in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity. Is College Tuition Tax Deductible 2020.

From nitisaraomran7.blogspot.com

Student Loans Deduction Nitisara Omran Is College Tuition Tax Deductible 2020 learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction. learn how to deduct up to $4,000. Is College Tuition Tax Deductible 2020.

From www.everythingcollege.info

What College Expenses Are Tax Deductible 2020 EverythingCollege.info Is College Tuition Tax Deductible 2020 learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. when the tuition and fees deduction was still in. Is College Tuition Tax Deductible 2020.

From myelearningworld.com

Analysis College Tuition Has Outpaced Inflation by More Than 3x Over Is College Tuition Tax Deductible 2020 in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. when the tuition and fees deduction was still in effect, those who attended an accredited college, university,. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends. Is College Tuition Tax Deductible 2020.

From www.pdffiller.com

Fillable Online Which College Education Expenses Are Tax Deductible Fax Is College Tuition Tax Deductible 2020 in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction. when the tuition and fees deduction was still in effect, those who attended an accredited. Is College Tuition Tax Deductible 2020.

From dxokymive.blob.core.windows.net

Is College Tuition Tax Deductible For Parents 2019 at Donna Gutierrez blog Is College Tuition Tax Deductible 2020 learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. when the tuition and fees deduction was still in effect, those who attended an accredited college, university,. use this form to deduct qualified tuition and fees paid in 2018, 2019,. Is College Tuition Tax Deductible 2020.

From www.pinterest.com

5 EducationRelated Tax Credits & Deductions for College Tuition Is College Tuition Tax Deductible 2020 education, especially college tuition, can be a big financial burden for students and their parents. use this form to deduct qualified tuition and fees paid in 2018, 2019, or 2020, and later years if legislation extends the deduction. learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents. Is College Tuition Tax Deductible 2020.

From www.studlife.com

WU announces tuition increase for 20202021 academic year Student Life Is College Tuition Tax Deductible 2020 learn how to deduct up to $4,000 for qualifying tuition expenses paid for you, your spouse, or your dependents in 2020. learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. when the tuition and fees deduction was still in. Is College Tuition Tax Deductible 2020.

From carissawtilda.pages.dev

Is College Tuition Tax Deductible 2024 Gerti Juliane Is College Tuition Tax Deductible 2020 learn about the tax credits and deductions you can use to offset the cost of college, such as the american opportunity tax credit, the lifetime learning credit. in general, qualified tuition and related expenses for the education tax credits include tuition and required fees for the. education, especially college tuition, can be a big financial burden for. Is College Tuition Tax Deductible 2020.