Towns County Ga Property Tax Rate . you can search our site for a wealth of information on any property in towns county and you can securely pay your property. the tax rate, or millage rate, is set annually by the towns county board of commissioners and the towns county. welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Ad valorem tax, more commonly known as property tax, is a large source of revenue. towns county tax|general information. the goal of the towns county assessors office is to provide the people of towns county with a web site that is easy to use.

from cdn-aarpsite.americantowns.com

the goal of the towns county assessors office is to provide the people of towns county with a web site that is easy to use. towns county tax|general information. Ad valorem tax, more commonly known as property tax, is a large source of revenue. welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. the tax rate, or millage rate, is set annually by the towns county board of commissioners and the towns county. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. you can search our site for a wealth of information on any property in towns county and you can securely pay your property.

Tax Guide What You’ll Pay in 2024

Towns County Ga Property Tax Rate you can search our site for a wealth of information on any property in towns county and you can securely pay your property. you can search our site for a wealth of information on any property in towns county and you can securely pay your property. the tax rate, or millage rate, is set annually by the towns county board of commissioners and the towns county. Ad valorem tax, more commonly known as property tax, is a large source of revenue. towns county tax|general information. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. the goal of the towns county assessors office is to provide the people of towns county with a web site that is easy to use. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. welcome to the online payment page for towns county, ga, where you can conveniently and securely process a.

From cloqnichol.pages.dev

State Tax 2024 Adena Brunhilde Towns County Ga Property Tax Rate towns county tax|general information. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Ad valorem tax, more commonly known. Towns County Ga Property Tax Rate.

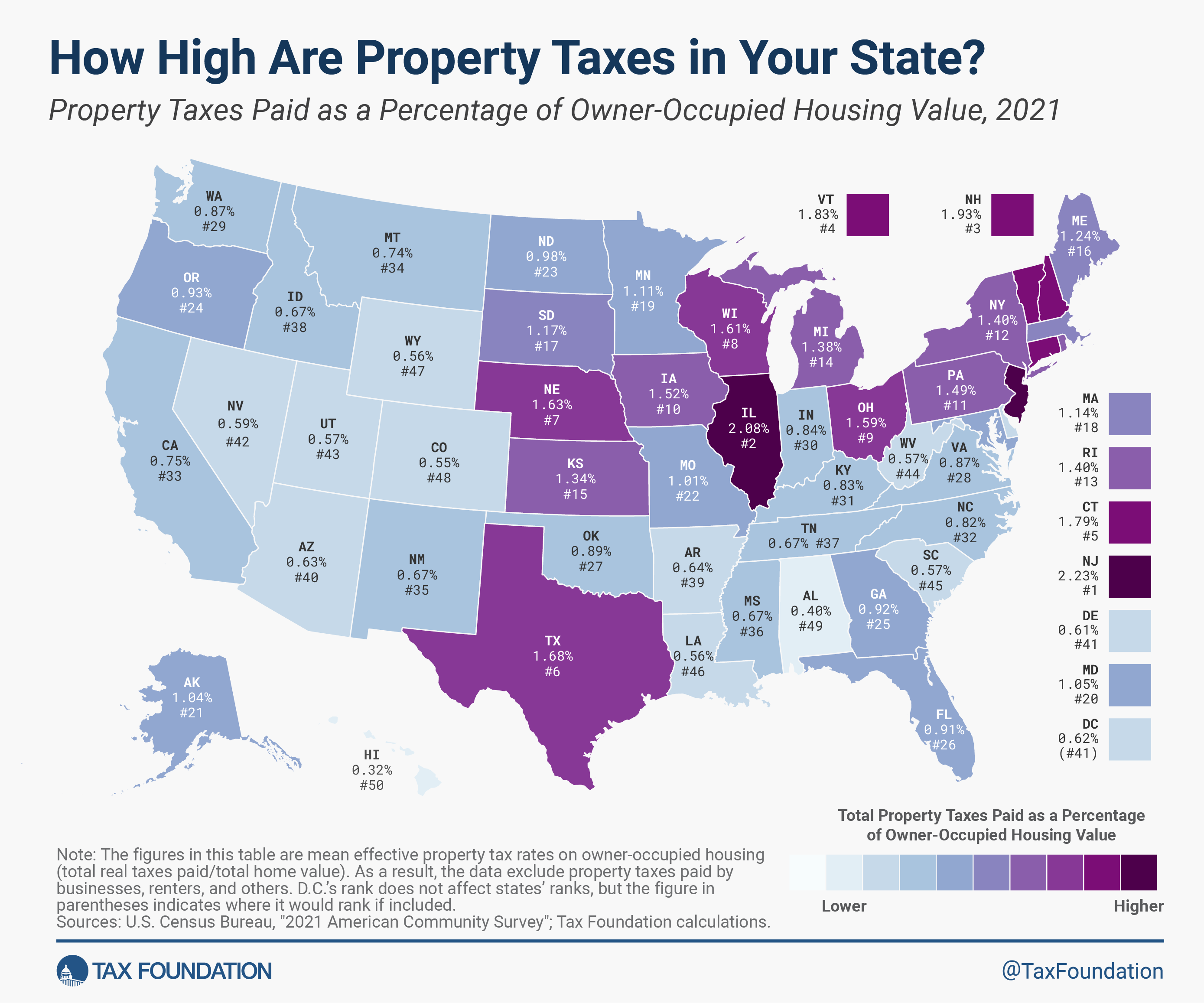

From taxfoundation.org

How High Are Property Tax Collections in Your State? Tax Foundation Towns County Ga Property Tax Rate Ad valorem tax, more commonly known as property tax, is a large source of revenue. you can search our site for a wealth of information on any property in towns county and you can securely pay your property. the tax is levied on the assessed value of the property which, by law, is established at 40% of the. Towns County Ga Property Tax Rate.

From exojwxziv.blob.core.windows.net

Pay Towns County Ga Property Taxes at Bonnie Padgett blog Towns County Ga Property Tax Rate towns county tax|general information. you can search our site for a wealth of information on any property in towns county and you can securely pay your property. the goal of the towns county assessors office is to provide the people of towns county with a web site that is easy to use. the median property tax. Towns County Ga Property Tax Rate.

From exosbfhjh.blob.core.windows.net

Forsyth County Property Tax Payment at Carolyn Pollock blog Towns County Ga Property Tax Rate the goal of the towns county assessors office is to provide the people of towns county with a web site that is easy to use. you can search our site for a wealth of information on any property in towns county and you can securely pay your property. the median property tax (also known as real estate. Towns County Ga Property Tax Rate.

From exommflzh.blob.core.windows.net

Troup County Ga Property Tax at Sandra Preston blog Towns County Ga Property Tax Rate you can search our site for a wealth of information on any property in towns county and you can securely pay your property. towns county tax|general information. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. the tax is levied on. Towns County Ga Property Tax Rate.

From susanntompkins.blogspot.com

fulton county ga property tax sales Susann Tompkins Towns County Ga Property Tax Rate Ad valorem tax, more commonly known as property tax, is a large source of revenue. welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. towns county tax|general information. the tax rate, or millage rate, is set annually by the towns county board of commissioners and the towns county.. Towns County Ga Property Tax Rate.

From rosalbamclean.blogspot.com

property tax exemption codes Rosalba Mclean Towns County Ga Property Tax Rate the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. towns county tax|general information. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. welcome to the online payment. Towns County Ga Property Tax Rate.

From tucson.com

The cities with the highest (and lowest) property taxes Towns County Ga Property Tax Rate the tax rate, or millage rate, is set annually by the towns county board of commissioners and the towns county. towns county tax|general information. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. welcome to the online payment page for towns. Towns County Ga Property Tax Rate.

From stephenhaw.com

Rates of Property Taxes in California's The Stephen Haw Group Towns County Ga Property Tax Rate the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. you can search our site for a wealth of information on any property in towns county and you can securely pay your property. towns county tax|general information. the goal of the towns. Towns County Ga Property Tax Rate.

From districtlending.com

Property Tax Rates By State Ranked Lowest to Highest [2024] District Towns County Ga Property Tax Rate the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Ad valorem tax, more commonly known as property tax, is a large source of revenue. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a. Towns County Ga Property Tax Rate.

From arpropertyexperts.com

Proposed Property Tax Notices ARE Solutions Towns County Ga Property Tax Rate you can search our site for a wealth of information on any property in towns county and you can securely pay your property. welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. the tax rate, or millage rate, is set annually by the towns county board of commissioners. Towns County Ga Property Tax Rate.

From decaturtax.blogspot.com

Decatur Tax Blog median property tax rate Towns County Ga Property Tax Rate the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. welcome to the online payment page for towns county, ga,. Towns County Ga Property Tax Rate.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Towns County Ga Property Tax Rate you can search our site for a wealth of information on any property in towns county and you can securely pay your property. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. Ad valorem tax, more commonly known as property tax, is a large. Towns County Ga Property Tax Rate.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Towns County Ga Property Tax Rate welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. the tax is levied on the assessed value of the property which, by law, is established at 40% of the fair market value. the goal of the towns county assessors office is to provide the people of towns county. Towns County Ga Property Tax Rate.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Towns County Ga Property Tax Rate welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. towns county tax|general information. the tax is levied on the assessed value of the. Towns County Ga Property Tax Rate.

From www.homeatlanta.com

Chamblee DeKalb County Property Tax Calculator. Millage Rate Towns County Ga Property Tax Rate welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. the goal of the towns county assessors office is to provide the people of towns county with a web site that is easy to use. the tax rate, or millage rate, is set annually by the towns county board. Towns County Ga Property Tax Rate.

From www.ezhomesearch.com

The Ultimate Guide to Property Tax Laws in Towns County Ga Property Tax Rate towns county tax|general information. welcome to the online payment page for towns county, ga, where you can conveniently and securely process a. the median property tax (also known as real estate tax) in towns county is $677.00 per year, based on a median home value of. the tax rate, or millage rate, is set annually by. Towns County Ga Property Tax Rate.

From exojwxziv.blob.core.windows.net

Pay Towns County Ga Property Taxes at Bonnie Padgett blog Towns County Ga Property Tax Rate the goal of the towns county assessors office is to provide the people of towns county with a web site that is easy to use. you can search our site for a wealth of information on any property in towns county and you can securely pay your property. Ad valorem tax, more commonly known as property tax, is. Towns County Ga Property Tax Rate.